The University Of Lethbridge’s Trading League

Sept 22/23 - NOV 17/23

The University of Lethbridge Finance Club has been hosting an inaugural trading competition/league since 2017. Using Rotman's RIT software, students compete in simulated trading cases on Friday afternoons during the fall semester. Each trading case will offer students the chance to enter a realistic market environment, allowing them to trade regular securities, derivatives, money market, fixed income instruments, and commodities. On Fridays participants will trade a case three times. Their performance will be tracked and scored based upon how consistent and profitable they are. Their scores will then be added to our rolling leaderboard. After the final case a winner will be crowned champion. The 2022 champion was Krishil Jasani (Congrats Krishil!). There will be an introduction to the club, its activities and a tutorial on how to use the RIT software on Friday September 22, 2023 at 3pm in the trading room in Markin Hall (M2044). All U of L students are encouraged to come out and participate in the league. The only prerequisite necessary is a passion for finance! The club’s President, Vice President and Treasurer will be in the trading room every Friday throughout the competition period at 3pm to 5pm to answer questions and help with strategies for the cases. A link to the case files, a brief description of each case and the dates they will be traded on are below:

CASE 1: Commodities Trading 1 (October 5, 2023 3:00pm in the trading room M2044)

In this case participants are asked to buy and sell futures contracts of crude oil. They must react to macroeconomic and geopolitical news to make their position.

CASE 2: Commodities Trading 4 (October 13, 2023 3:00pm in the trading room M2044)

In this case participants will be able to lease two different oil refineries that turn crude oil into gasoline and heating oil. The participants must create models using Excel to determine whether or not they should refine based on the inputs costs of crude oil, the lease cost of the refineries and the output prices of gasoline and heating oil.

CASE 3: Liability Trading 3 (October 20, 2023 3:00pm in the trading room M2044)

In this case participants will receive offers from institutional clients to buy/sell shares of a security and then based on the liquidity in the public market they will decide if they want to tender the institutions order. If they do accept the offer they must then attempt to sell or buy back the shares at a profit… Brad Katsuyama style!

CASE 4: Options 2 (October 27, 2023 3:00pm in the trading room M2044)

In this case participants will get exposure to options and will be asked to set up option positions. These include straddles, strangles, butterflies and corridors.

CASE 5 : Options 3 (November 3, 2023 3:00pm in the trading room M2044)

Case 5 is the grand daddy of them all. Separating the adults form the children. It asks participants to set up a delta neutral options strategy. Participants will be able to trade puts and calls at 5 different strike prices on an underlying ETF. The option contracts will expire in one month. Participants will also receive information about the future volatility of the underlying ETF and must set up there strategies to profit from this information (i.e., going long volatility or short volatility).

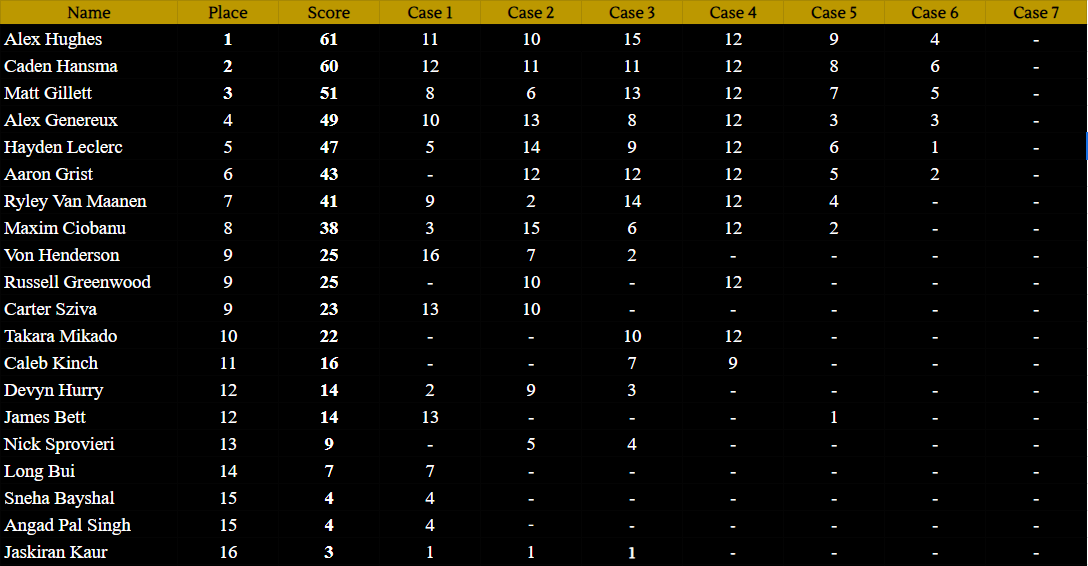

2023 Rolling Leaderboard:

2022 Competition:

2021 Competition:

2019 Competition:

2018 Competition:

2017 Competition: